We develop the Swedish venture capital market

Saminvest helps stimulate private capital within areas of different industries and business sectors where, at the time of the investment, private capital is sufficiently lacking.

This is done through investments in privately managed funds and angel investor programmes, in which Saminvest often acts as an anchor investor. We actively work to support the establishment of new management teams so that the Swedish venture capital ecosystem can grow and develop. Saminvest also places clearly defined requirements for funds to pursue sustainability in its investments and proactively increase gender equality in its teams. Our investments are based on market returns, which is an important prerequisite for private capital to want to co-invest with us. Saminvest currently manages assets of approximately 6 billion Swedish krona.

Industry sectors and phases of investment

The needs of the market and principal areas of investment change over time. Therefore, our investment operations have to be flexible in terms of sectors, investment phases, and geographical areas.

The investment funds and angel investors that we have worked with so far are active in a number of different sectors that range from Life Science to Tech. The angel investors focus on pre-seed and early seed funding, while the investment funds focus varies from seed to growth.

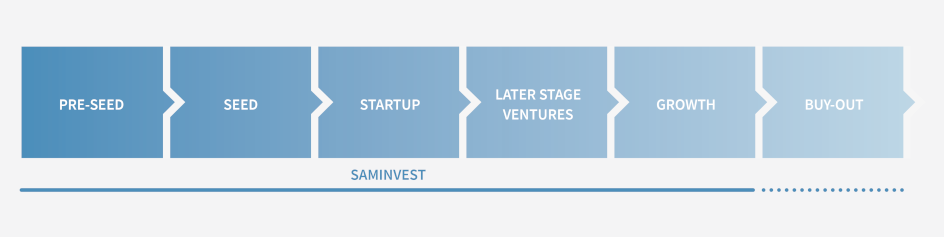

Investment phases

Saminvest’s role of supplementing the market means that our investment efforts are directed towards segments where, at the time of the investment, private capital is not sufficiently available. Saminvest’s focus is independent of the investment industry and can work with funds and angel investor programmes that are active in all the early phases of developing companies, from seed funding to early growth. Saminvest does not invest in funds that focus on loan-financed acquisitions, so-called buyouts.